最後更新日: 2024年01月23日

Larry Summers一連兩篇網誌指聯儲局官員(特別是Janet Yellen)在Jackson Hole的演說反映該局過份自份,情況令他擔心。

在第一篇《Disappointed by what came out of Jackson Hole》,Summers就認為聯儲局官員在Jackson Hole會議中不停發放短期將收緊貨幣政策的訊號,將會損害該局的信用,甚至打擊經濟。

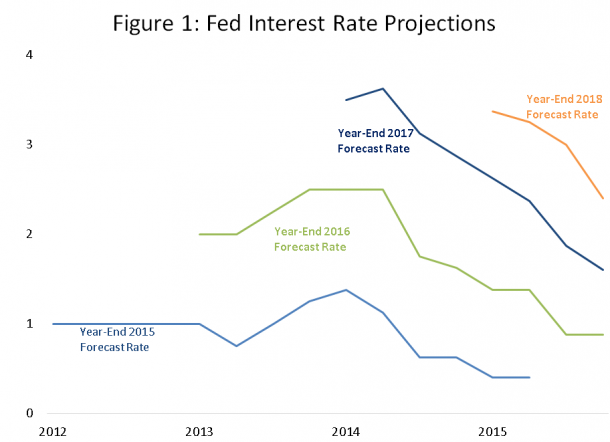

首先,Summers指出FOMC自2008年以來一直高估經濟復甦的情況,並幾年來都預計可在短期內推動利率正常化,但都事與願違。(下圖)

For nearly a decade, since the mid 2008 FOMC meetings where many believed that the worst had past, the Fed been too serene about the economic outlook and a return to past regularities. When the Fed predicted last December that it would raise rates four times in 2016, market participants saw a disconnect from reality. It has been that way for a long time. Figure 1 shows the Fed’s forecasts of its future monetary policies since they began releasing them. The Fed has always believed that rate increases and normalization were around the corner but never been able to deliver.

Yellen在Jackson Hole的演說其實本來被市場認為是「偏鴿」,但之後副主席Stanley Fischer在CNBC的訪問中示意年內加息兩次是可行,令市場改為判定聯儲局為立場為較鷹。但Summers認為聯儲局應該採取「極鴿」的立場,因為聯儲局的2%通脹目標應該「對稱」,即是通脹長期低於2%後,就應該容許通脹高於2%一般時間,這才可以令通脹「平均」達致2%。而目前以十年期國債推算的Break-even通脹率(亦即市場對通脹的預期)只有1.2%左右,實在未有足夠理由需要加息。

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》