周二聯儲局公佈左月初議息會議嘅紀錄,大新聞嘅當然係官員開始覺得可以考慮較慢嘅減息節奏,同埋部份官員認為自然利率嘅估算有好大嘅不確定性,所以要小心啲減息。但老實講呢啲都係已知嘅諗法,亦都未考慮到Trump上台帶黎嘅衝擊,所以前膽性我就覺得有限。

但會議紀錄提到一件事就相當有趣:

Some participants remarked that, at a future meeting, there would be value in the Committee considering a technical adjustment to the rate offered at the ON RRP facility to set the rate equal to the bottom of the target range for the federal funds rate, thereby bringing the rate back into an alignment that had existed when the facility was established as a monetary policy tool.

部份官員認為聯儲局要考慮下將ONRRP利率(全名為Overnight Reverse Repo利率)下調5點子,即係將佢定喺聯儲局目標利率目標區間下限。

我唔想做太多ONRRP嘅教學/解釋,否則篇文又會好長,但基本就係IORB同ONRRP係聯儲局兩大利率工具,用黎維持市場隔夜利率水平,而兩者唔同嘅係可以參與ONRRP嘅金融機構較多,可以幫助影響IORB未能直接影響嘅機構。(有興趣可以睇下Byron呢篇教學《貨幣市場基金的角色》)

依家個問題係,點解要將ONRRP利率調低? 因為,首先聯儲局原先嘅設置就係要將ONRRP定喺目標利率下限,但去定2021年6月先首次調至「高於目標下限」0.05個百分點。

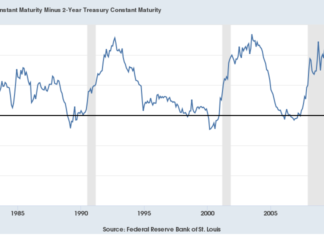

當時聯儲局要處理嘅問題,係聯邦儲備利率(EFFR)同埋市場隔夜利率都「太低」,相當接近目標下限。下圖橙色就係ONRRP利率,喺6月15日嘅會議調高左。圖中紅色就係市場隔夜利率SOFR嘅水平,係2021年上半年SOFR跌到相當接近0%,亦都低過聯邦儲備利率(灰藍色綫)。咁聯儲局就利用ONRRP嘅市場利率「下限」功能(因為你可以放錢入聯儲局收呢個息率,就唔會用低過呢個息率借錢出市場),輕輕調高ONRRP利率,成功SOFR都抽高去0.05%,而EFFR都高左少少。

呢個調高ONRRP嘅方法都一直調有效,但依家喺長期QT之下,聯儲局開始到嘅係另一個「問題」:市場利率(如SOFR)偏高。

近幾個月,SOFR唔少時間都高過EFFR,咁令到聯儲局再諗下需唔需要令ONRRP高過目標下限。局方嘅研究人員喺會上就指出:

The staff reviewed developments with respect to the usage of the ON RRP facility. The staff also noted that lowering the ON RRP offering rate 5 basis points would align the ON RRP offering rate with the bottom of the target range for the federal funds rate and would probably put some downward pressure on other money market rates.

簡而言之就係將ONRRP利率調返低,咁市場就可以多返啲資金,有助降低市場隔夜利率水平,令利率更為受控。

其實聯儲局研究員作出呢個建議嘅一個前提,喺9月尾曾經出現SOFR高過目標上限嘅情況。佢地嘅總結係問題唔大,為「季結正常情況」:

Market contacts attributed the pressures seen around the quarter-end to a combination of typical balance sheet constraints associated with financial reporting dates and a large net settlement of Treasury coupon securities that took place on the same day. Overall, developments in the repo market at the end of September and in early October appeared to conform with the typical quarter-end pattern, although the spike in repo rates observed on those days was the largest in the post-pandemic period.

但減低ONRRP利率可以避免呢個情況的話,何樂而不為?

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》