最後更新日: 2024年01月23日

今個星期歐央行議息,會否再加推刺激政策其實我無明確的看法,但近日見到一個有趣的討論,值得了解。

根據瑞信最近一份研究報告《I’ve been expecting you, Mr Bond scarcity …》指出,其實歐央行資產購買計劃中購買國債的部份,可能快將出現在個別地區無債可買的情況。

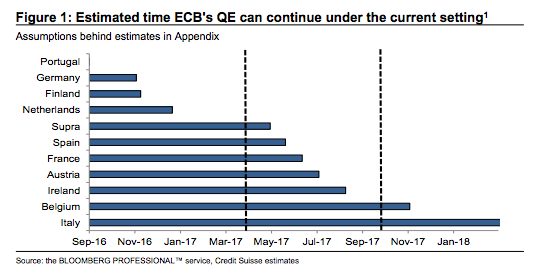

上圖為瑞信就歐央行在區內各國仍可買國債的時間估算,其中可以見到葡萄牙已無債再合適歐央行購買,而德國國債所餘下的時間亦大約只有兩個月。

這個情況令歐央行面對困境,要不就改變一系列可買國債的條件,或者就推出新的貨幣刺激政策。而近日受熱烈討論的一個新政選擇,就是歐央行將資產購買計劃,由現時定量(即是預先定下每月購買的規模)改為定價,明確定下各國債券的長債息率目標,實行Long Term Yield Targeting。

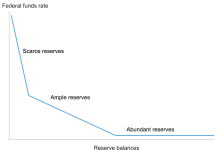

先簡單講一講背景資料,現時各國央行的所謂「基準利率」都是隔夜至一星期的短期利率,而以往央行一般只管短期利率而任由市場決定長期利率;直至金融海嘯後,各主要央行才推行QE政策來主動調控長綫利率,但通常的做法都是定下每月的國債購買量,長綫利率高低某程度仍由市場決定。現時這個Yield Targeting的建議,就是歐央行明確指出「理想」的長綫利率,而該行將透過買賣國債來「維持」這長綫利率水平。

這個建議之所以獲討論,是因為在今年Jackson Hole會議中,歐央行的委員Benoit Coeuré在講稿中提到,以下為相關的段落:

A target focused on short-term interest rates makes sense when this is the main policy variable, but if short-term rates are persistently pushed towards the lower bound, monetary policy has to focus on a wider constellation of rates across different maturities and asset classes. What then is its target? Central bankers currently offer quantity targets in these cases – a volume of assets to be bought per month – but price targets are only given in general terms, for instance “flattening the yield curve”. This is appropriate so long as balance sheet policies are temporary. It may not be in the long term, but moving to price targets may come at the expense of price discovery…

…The ECB’s operational framework and its monetary policy strategy are robust and sufficiently flexible to deal with the current challenges. We will fulfil the price stability mandate given to us by the Treaty. But if other actors do not take the necessary measures in their policy domains, we may need to dive deeper into our operational framework and strategy to do so…

他提到以短期利率作目標的貨幣政策在正常情況可行,但面對現時名義利率接近Effective Lower Bound的情況,短息可能不再是唯一合適的政策目標。而定量QE作為一個應對短暫經濟不景的臨時政策,是合理的,惟若果經濟問題是長期持續的,例如自然利率的下跌是永久的話, Coeuré就認為歐央行要考慮跳出目前的政策框架。

參考讀物:ECB warnings and yield target allusions | FT Alphaville

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》