最後更新日: 2025年08月23日

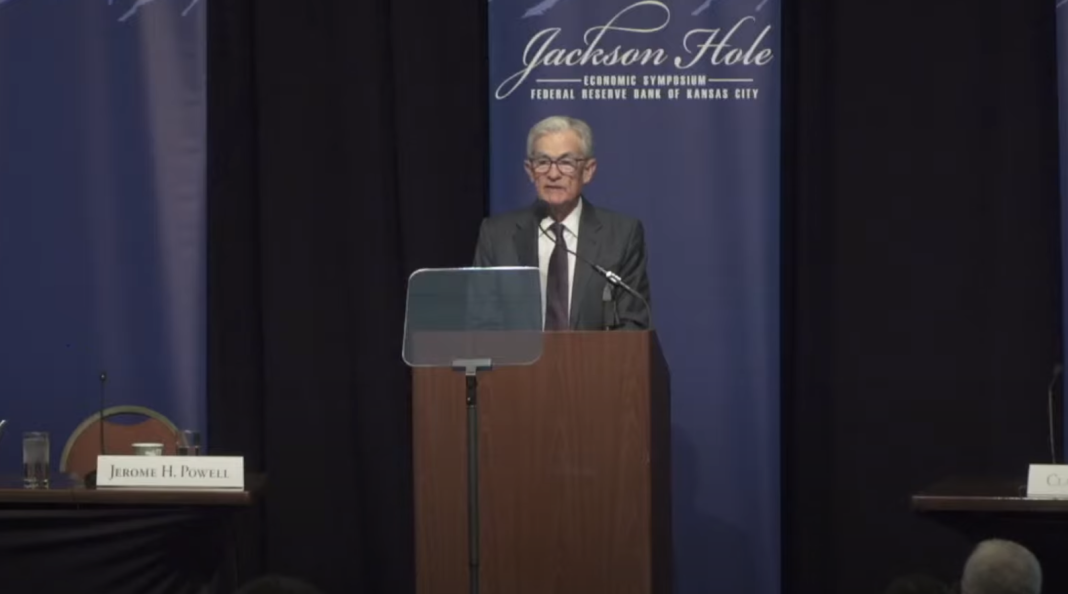

聯儲局主席Jerome Powell喺星期五嘅Jackson Hole演說講左呢句:

… with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance

即係基於佢嘅基礎經濟預測及通脹與就業嘅風險比例開始改變,而由於聯儲局嘅利率政策目前仲係「偏向緊縮」,所以可能有需要調整利率 — 即係可以減息啦。

呢個係最簡單要知道嘅內容,可以完架啦。不過老實講,呢篇演說有幾多頗精彩嘅內容係值得細睇嘅。

首先Powell講左勞動市場嘅情況,特別係BLS上次大幅修訂左5月同6月嘅非農就業增長之後,點樣改變Powell嘅睇法。

首先就係就業增長大減會帶黎太大嘅閒置勞動力,即係失業無大升啦。Powell嘅解讀就係因為勞動力供應係同需求一齊下降,令所謂嘅「breakeven」職位創造率(即係唔會令失業率上升嘅最低就業創造速度)都低左。

最總結到佢諗法嘅就係:

Overall, while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising.

佢認為呢個「奇怪嘅均衡」背後反映嘅,都係勞動市場嘅風險上升緊,因為可能同大量裁員及失業情況愈黎愈近。

Powell對勞動市場嘅分析搶眼,因為可以直接解釋到佢點解會開始放風減息。但其實佢都通脹嘅分析都好值得睇。

同以往有少少分別嘅就係佢明講「關稅對消費者價格嘅影響清晰可見」(The effects of tariffs on consumer prices are now clearly visible)。不過,見到又唔代表個影響會好大。目前Powell對個影響嘅基準預測都係「升完就無」(a one-time shift in the price level),只係未必會所有價格一齊升,特別係唔少都視乎供應鏈嘅建構先知會升幾多同幾耐。

不過,重點其實係Powell對於兩種「關稅可以引致持續通脹」嘅論述都唔似太同意。一個就係關稅引致嘅通脹令勞工要求加人工,但上面都講左,依家個勞動市場係轉緊弱,點會仲有得加人工呢?另一個講法就係關稅效應令通脹預期上升,但Powell都講目前啲長綫嘅通脹預期,不論係市場價格推算定係問卷調查作基礎嘅,都係相當穩定係約2%嘅水平,暫時無呢個擔心。

將兩個聯儲局嘅政策目標放埋一齊睇,就係通脹有上升嘅風險、就業有減少嘅風險,亦即係所謂嘅滯脹趨向(stagflationary),所以Powell明言係「a challenging situation」。咁我地亦都可以返到去最開頭講嘅,因為兩個貨幣政策目標都有風險,所以Powell嘅判斷唔再係通脹問題大啲,而係兩個問題一樣咁大,所以個結論係咩? 就係減息….. 去到利率變返「中性」(Neutral)水平。

我明白今日市場嘅反應咁大,多多少少同早兩日大家擔心今次Powell唔會特別提到減息,所以當Powell講到咁明顯,大家都喜出望外。但我會提醒大家,目前Powell真係似只係想調整個利率去到中性,唔係大幅減息。

呢個亦係同聯儲局個最新改版嘅貨幣政策框架(Moentary Policy Framework)有關。最新處理滯脹風險嘅講法係咁嘅:

if the Committee judges that the objectives are not complementary, it follows a balanced approach in promoting them, taking into account the extent of departures from its goals and the potentially different time horizons over which employment and inflation are projected to return to levels judged consistent with its mandate

之前講嘅係會特別留意勞動市場嘅「轉差」(shortfall)同通脹與2%目標嘅「偏離」(deviations),但依家強調嘅就係要「平衡」兩個目標嘅變動。通脹同就業兩邊都變差緊? 咁放返個利率去中性水平,再睇下邊個會差得快啲再決定救邊一個啦。我相信呢個就係Powell聯儲局喺餘下時間會所採納嘅論述啦。

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》