最後更新日: 2025年01月21日

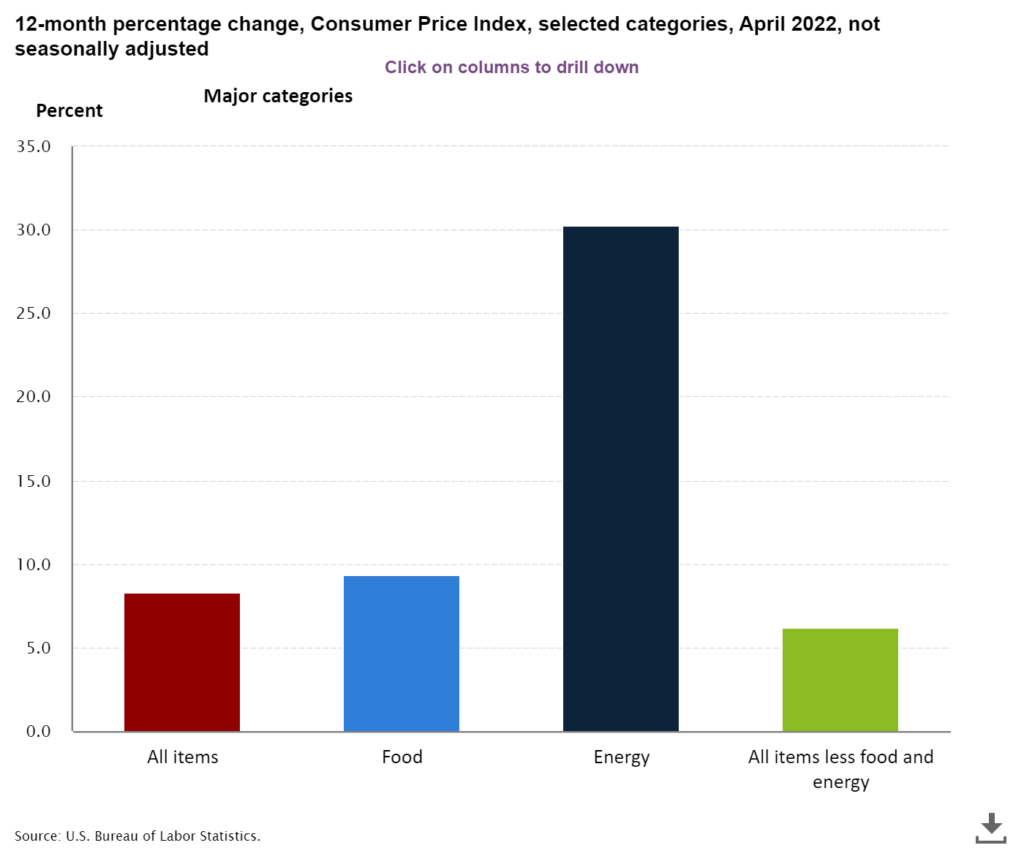

美國四月通漲率為8.3% (按年),較3月嘅8.5%輕微回落,但仍超預期嘅8.1%。如果計所謂嘅核心通漲(扣除食物及能源)增長為6.2%,都係較3月(6.5%) 有所回落。

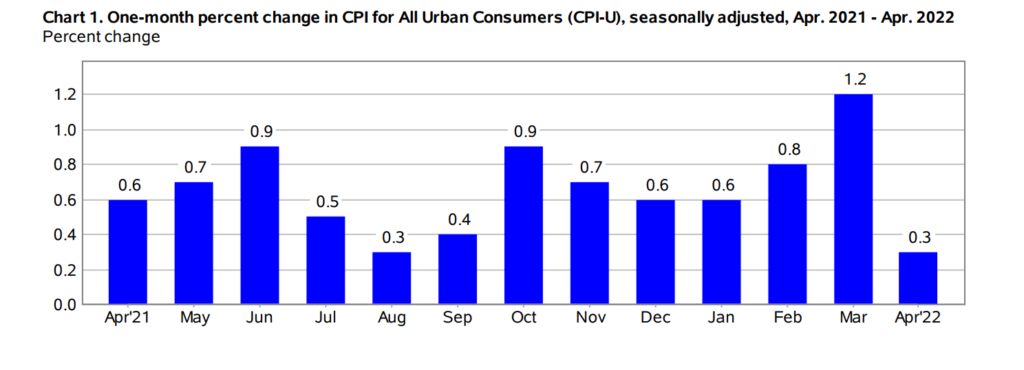

值得留意,係一方面按月整體通漲升幅四月只係0.3%,同上個月嘅1.2% 相比低好多。一個原因係汽油價格按月錄得6.1%嘅跌幅。

👀Advertisement👀

不過,食品價格仍然有0.9%嘅按月上升,電費及燃氣等嘅能源服務仍然有1.3% 按月升幅。交通服務更有按月3.1%嘅價格上漲。

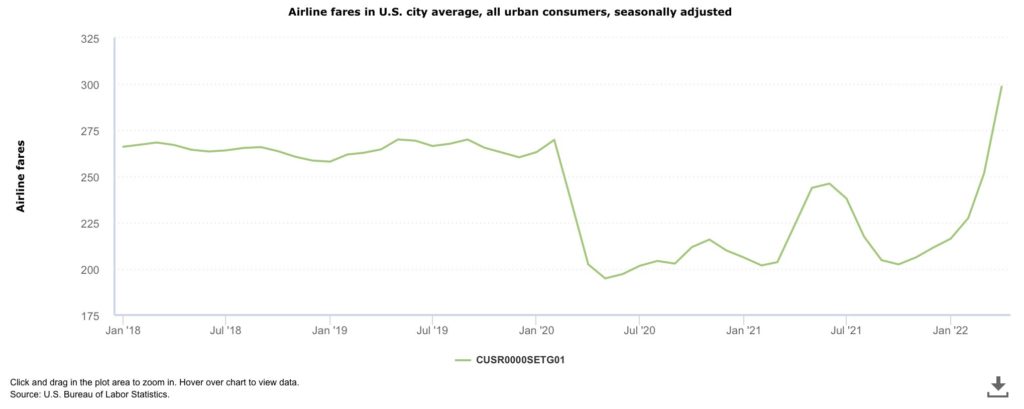

咁交通服務係咩一回事?

Lisa Abramowicz on Twitter: “Why did U.S. inflation come in so much hotter than expected? In large part due to airplane tickets getting much more expensive. Airfares rose 18.6% month over month, “well above the 5.5% increase we were expecting:” Morgan Stanley / Twitter”

Why did U.S. inflation come in so much hotter than expected? In large part due to airplane tickets getting much more expensive. Airfares rose 18.6% month over month, “well above the 5.5% increase we were expecting:” Morgan Stanley

原來交通服務嘅升幅主要係由機票價格按月上升18.6%所帶動。呢個相信係需求太旺同埋低基數所帶動

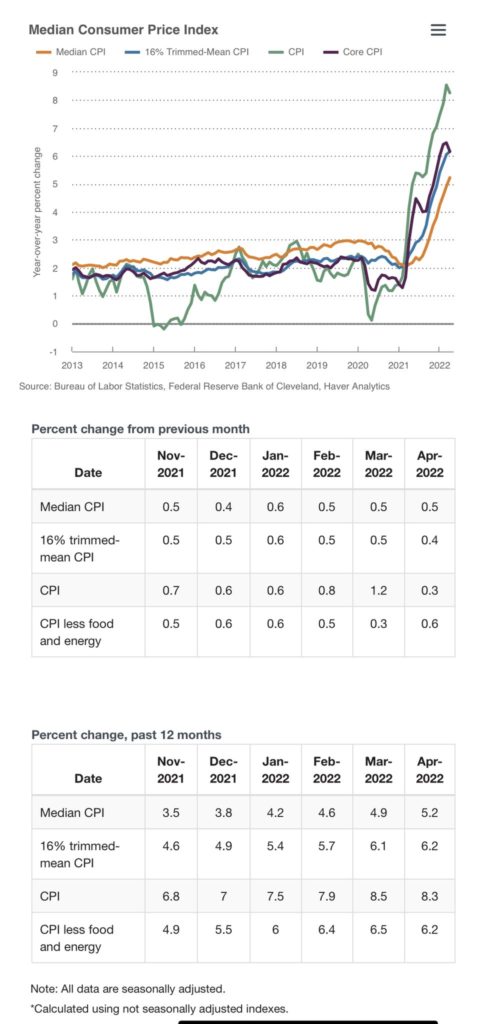

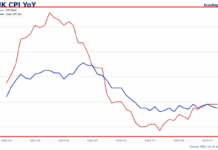

更新: 補充多一個通漲走勢數據。下圖為Cleveland Fed嘅Median CPI 與及 Trimmed-mean CPI數字,兩者嘅目標都係去除極端升跌幅項目對CPI數據嘅影響,以估算所謂嘅Underlying Inflation。 4月嘅數字顯示,目前美國通漲未有明顯轉弱嘅趨勢,甚至按年數字反映通漲進一步上升。

🚨Advertisement🚨

當然,一個月嘅輕微升跌,又無須過份解讀嘅。

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》

🚨Advertisement🚨