最後更新日: 2024年04月12日

之前寫左兩篇文講金融海嘯前同後嘅利率制度,收視好一般。相信好多讀者都唔明,無端無故做咩要寫啲咁技術性嘅文章。

事實係寫呢兩篇文,正正係為聯儲局12月嘅議息會議紀錄做準備,因為兩個利率制度之間嘅決擇,開始左右聯儲局係縮減資產表嘅決定。

由於本文都唔會短,所以好難詳細再次描述兩個利率制度不同,你有需要重睇兩篇文。

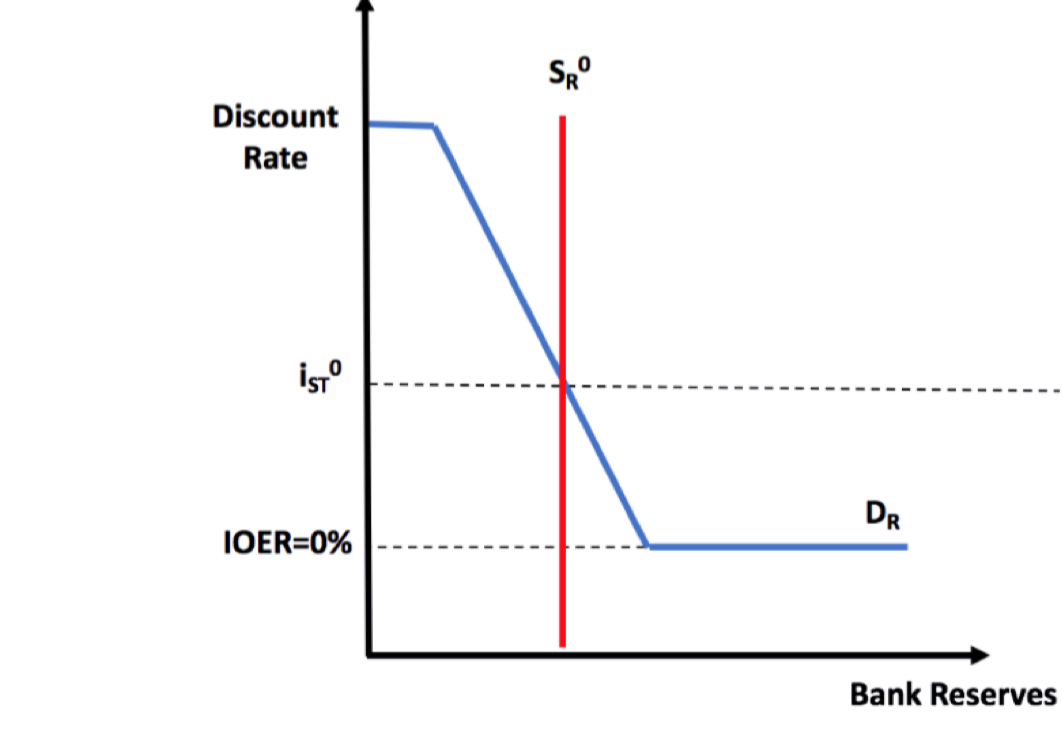

簡單而必須嘅資料係,2008年前聯儲局係採用常稱為Corridor Syetem(走廊式)控制利率,儲備供應同需求嘅交义點,處於儲備需求曲綫右向下斜嘅部份,因此聯儲局可以透過改變供應黎升降銀行同業拆息(即聯邦儲備利率,FFR)嘅水平。

2008年後聯儲局轉用所謂嘅Floor System(地板式),儲備供求交义點改為需求曲綫下方扁平區域,聯儲儲備利率調控嘅唔再取決於儲備供應,而係多餘儲備利率(IOER)及逆回購利率(RRP)。

都討論過幾次,近半年多聯儲局面對嘅問題係市場決定嘅實際聯邦儲備利率(EFFR)偏離聯儲局利率目標區間(依家係2.25至2.5厘)中位數,並升至同IOER呢個原定為區間頂部一致。

個問題係咩呢?根據聯儲局對Floor System嘅理解,EFFR應該要長期低於IOER。因為IOER係銀行儲錢係聯儲局嘅無風險利率,當IOER高過EFFR即係銀行持有儲備嘅機會成本接近零,呢個係維持聯儲局資產表一定規模嘅基礎條件;若果EFFR高過IOER,銀行持有儲備就變成有成本,呢個情況可能一下子將利率制度由Floor System推返去Corridor System。

都唔明問題係咩?Corridor System唔好咩? Corridor System其實無問題,唔少學者甚至認為係兩者中較為可取之選,因為多年以黎恆之有效。

問題係:

1)聯儲局嘅傾向係維持採用Floor System;

2)係無準備下突然變回Corridor System,即係聯儲局要緊急撤銷縮減資產表嘅行動,市場未必接受到。

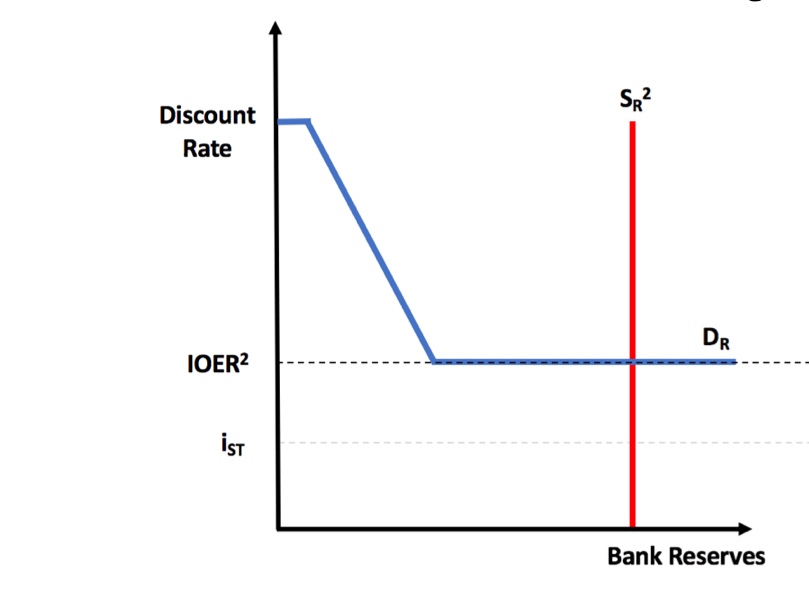

係Floor system定Corridor system嘅決定因素,係銀行體系入面儲備總額多唔多。理論上,介乎兩者之間有一個名為「飽滿儲備量」(saturated level of reserves) 嘅水平,高過佢就係Floor System,低過就要變返Floor System。

問題係,聯儲局其實唔肯定「飽滿儲備量」係幾多!

如果單單回看歷史,「飽滿儲備量」似係2010年左右為大約一萬億美元。但呢個理論儲備量會因應社會嘅經濟發展、貨幣需求量、銀行營運模式及銀行業監管要求而改變。一個學界共識就係現時嘅「飽滿儲備量」一定高過2010年時嘅水平,但實際係幾多就無明確嘅共識。

所以,當EFFR長期同IOER同等水平,就令聯儲局官員相當擔憂。會議紀錄中呢段係重點:

However, reducing reserves to a point very close to the level at which the reserve demand curve begins to slope upward could lead to a significant increase in the volatility in short-term interest rates and require frequent sizable open market operations or new ceiling facilities to maintain effective interest rate control. These considerations suggested that it might be appropriate to instead provide a buffer of reserves sufficient to ensure that the Federal Reserve operates consistently on the flat portion of the reserve demand curve so as to promote the efficient and effective implementation of monetary policy.

可以見到,聯儲局覺得將儲備供應推返去接近儲備需求右向下斜區域(即corridor system),會令短期利率大幅波動,而且局方可能要不停採用公開市場操作(即買入短期國債)黎壓低短期利率,情況唔太可取;所以佢地應為將儲備量留係「飽滿儲備量」以上,再加加一個好穩定嘅緩衝量,令佢地可以確信利率制度可以留係Floor system。

但因為聯儲局唔知道「飽滿儲備量」係邊,只知道EFFR等同IOER,係Floor system無法維持嘅初期訊息,因此聯儲局官員開始思考呢個重要決定:

Some participants commented on the possibility of slowing the pace of the decline in reserves in approaching the longer-run level of reserves. Standard temporary open market operations could be used for this purpose. In addition, participants discussed options such as ending portfolio redemptions with a relatively high level of reserves still in the system and then either maintaining that level of reserves or allowing growth in nonreserve liabilities to very gradually reduce reserves further. These approaches could allow markets and banks more time to adjust to lower reserve levels while maintaining effective control of interest rates.

無錯,就係減慢資產表縮減速度。

但你睇左我咁大篇文,你應該要明白聯儲局呢個考量,並唔係因為佢地覺得減資產表對股市有負面影響,而係因為聯儲局擔心再縮減資產表,該局可能失去對短期利率嘅控制!又或者,至少係聯儲局唔可以再如願以Floor System控制利率,並且為貨幣市場帶黎不必要嘅波動。

呢個,係了解Floor / Corridor system嘅重要性,否則你只會好似大部份媒體咁,只集中認為聯儲局係救市所以考慮要減慢縮資產速度。

正如會議紀錄呢句:

Several participants, however, expressed concern that a slowing of redemptions could be misinterpreted as a signal about the stance of monetary policy.

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》