最後更新日: 2024年07月29日

十二月就快到,即是聯儲局可能快將加息﹐所以又是時候多做一些Fed 觀察的文章。今次想同各位看的,是上星期公佈的十月議息會議記錄。

各大媒體有關這會議記錄的報道,主要集中提及會上多位FOMC成員認為,只要經濟數據無太大的偏差,十二月的議息會議(會期為12月15 – 16日)為合適的加息時間。

Some participants thought that the conditions for beginning the policy normalization process had already been met. Most participants anticipated that, based on their assessment of the current economic situation and their outlook for economic activity, the labor market, and inflation, these conditions could well be met by the time of the next meeting.

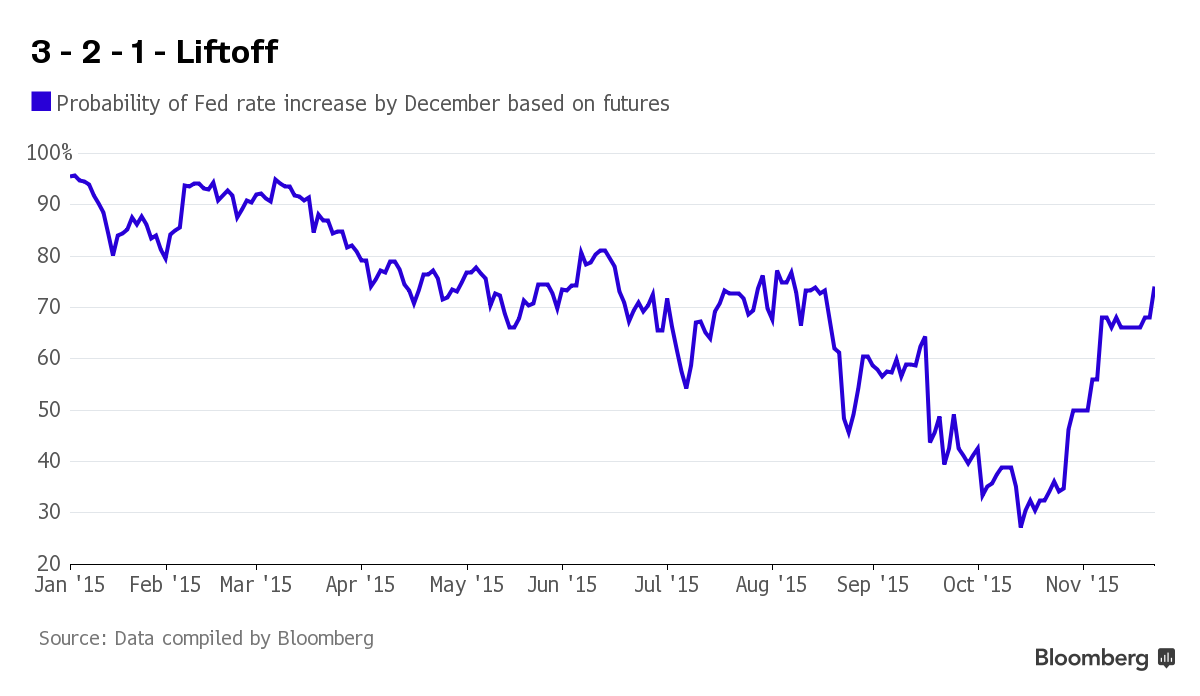

這一段記錄令市場人士更相信下次會議聯儲局就可以加息;到今日,利率期貨推算的加息機率大約74%。

但作為經濟記者,當然不單看會議記錄直接討論貨幣政策的部份,其實今次的會議記錄有一部份是記錄FOMC成員就貨幣經濟理論的討論,而主題正是本網早前探討過的自然利率!

簡單介紹,自然利率亦即是整個經濟體的均衡實質利率(Equilibrium Real Interest rate),當現實上出現的實質利率與這理論上的均衡水平一致,整體經濟就會達致全民就業,而通脹亦可維持在穩定的低水平。

在今次會議記錄中,開首的第一段就是討論自然利率及貨幣政策的互動關係。

The staff presented several briefings regarding the concept of an equilibrium real interest rate–sometimes labeled the “neutral” or “natural” real interest rate, or “r*”–that can serve as a benchmark to help gauge the stance of monetary policy. Various concepts of r* were discussed.

According to one definition, short-run r* is the level of the real short-term interest rate that, if obtained currently, would result in the economy operating at full employment or, in some simple models of the economy, at full employment and price stability.

根據儲局職員的研究,美國短期自然利率自2008年金融海嘯開始就一直下跌,甚至已經可能見負數。這個我們在上一篇文章都有提及;而聯儲局職員的看法是近年自然利率雖有所回升,但仍然相信處於零左右的水平,遠未能回復至海嘯前的「正常」水平。

Estimates derived using a variety of empirical models of the U.S. economy and a range of econometric techniques indicated that short-run r* fell sharply with the onset of the 2008-09 financial crisis and recession, quite likely to negative levels. Short-run r* was estimated to have recovered only partially and to be close to zero currently, still well below levels that prevailed during recent economic expansions when the unemployment rate was close to estimates of its longer-run normal level.

🚨Advertisement🚨

局方的職員研究亦指出,短期自然利率走低至近零的情況,在多個成熟經濟體都有出現。而理論上,除非這些經濟體的Total Productivity Factor增長速度上升(好簡單的非學術說法係生產力增速上升),及人口老化不再拖累工作年齡人口增長,否則自然利率大有機會持續在低水平。

Moreover, economic theory indicates that the equilibrium level of short-term real interest rates would likely remain low relative to estimates of its level before the financial crisis if trend growth of total factor productivity does not pick up and if demographic projections for slow growth in working-age populations are borne out.

重點來啦,自然利率點影響聯儲局的貨幣政策決策?局方職員指出,近年美國失業率持續下跌,某程度反映該國的實質GDP增長輕輕高於Potential GDP增長;換句話說,美國的GDP總額正逐步追近Potential GDP,即是產能過盛的問題正慢慢解決。

從利率角度看,就是美國的實質利率愈來愈近自然利率;就是說,雖然實質利率仍然因為零息政策加上低通脹,而相當接近零,但因為自然利率都是在差不多零的水平,所以兩者可能差距不大!

The unemployment rate has declined gradually in recent years, indicating that real gross domestic product (GDP) growth has, on average, exceeded growth of potential GDP, but not by a substantial margin. This outcome, in turn, suggested that the actual level of short-term real interest rates has been below but not substantially below the equilibrium real rate, consistent with estimates that r* currently is close to zero, notably below its historical average.

FOMC官員又點睇?會議記錄顯示,不少官員都認為自然利率將會隨經濟增長而上升;而官員亦了解短綫自然利率將有機會無法升回海嘯前水平;長綫而言,可以令實質利率,與自然利率看齊的聯邦儲備利率水平,有機會低於以往的「正常水平」,即是說,以往聯儲局利率可能要升至5厘左右才算「正常」,在現時的經濟環境可能不再需要這樣高。

A number of participants indicated that they expected short-run r* to rise as the economic expansion continued, but probably only gradually. Moreover, it was noted that the longer-run downward trend in real interest rates suggested that short-run r* would likely remain below levels that were normal during previous business cycle expansions, and that the longer-run normal level to which the nominal federal funds rate might be expected to converge in the absence of further shocks to the economy–that is, the level that would be consistent, in the long run, with maximum employment and 2 percent inflation–would likely be lower than was the case in previous decades

總論就是,雖然自然利率持續處於低水平,但同時自然利率正正慢慢上升,這令低息政策的必要性遂漸減低。

另一方面,從自然利率的角度,可以預視聯儲局就算開始加息,未來加息的空間亦不會太多。雖然未知這會否成為加息速度及幅度較低的理由,但有FOMC官員提到,這個低自然利率問題,可能令將來聯儲局在應對下次經濟危機時,無足夠減息空間去提振經濟,所以有需要考慮採用其他貨幣政策工具,去解決這潛在問題。

A smaller gap might increase the frequency of episodes in which policymakers would not be able to reduce the federal funds rate enough to promote a strong economic recovery and rapid return to maximum employment or to maintain price stability in the aftermath of negative shocks to aggregate demand. Some participants noted that it would be prudent to have additional policy tools that could be used in such situations.

延讀

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》