最後更新日: 2024年08月01日

英倫銀行減息四分一厘,將利率目標減至5厘。九名央行官員以5比4通過減息,以降低貨幣政策嘅緊縮效應。

好問題黎啦,啲官員點睇服務業通脹係第二季三個月都高過該行預期呢?

該行嘅議息會議紀錄入面有三個位講過呢個問題。首先係概括官員喺會內嘅對本地經濟指標嘅討論時,總結成呢句:

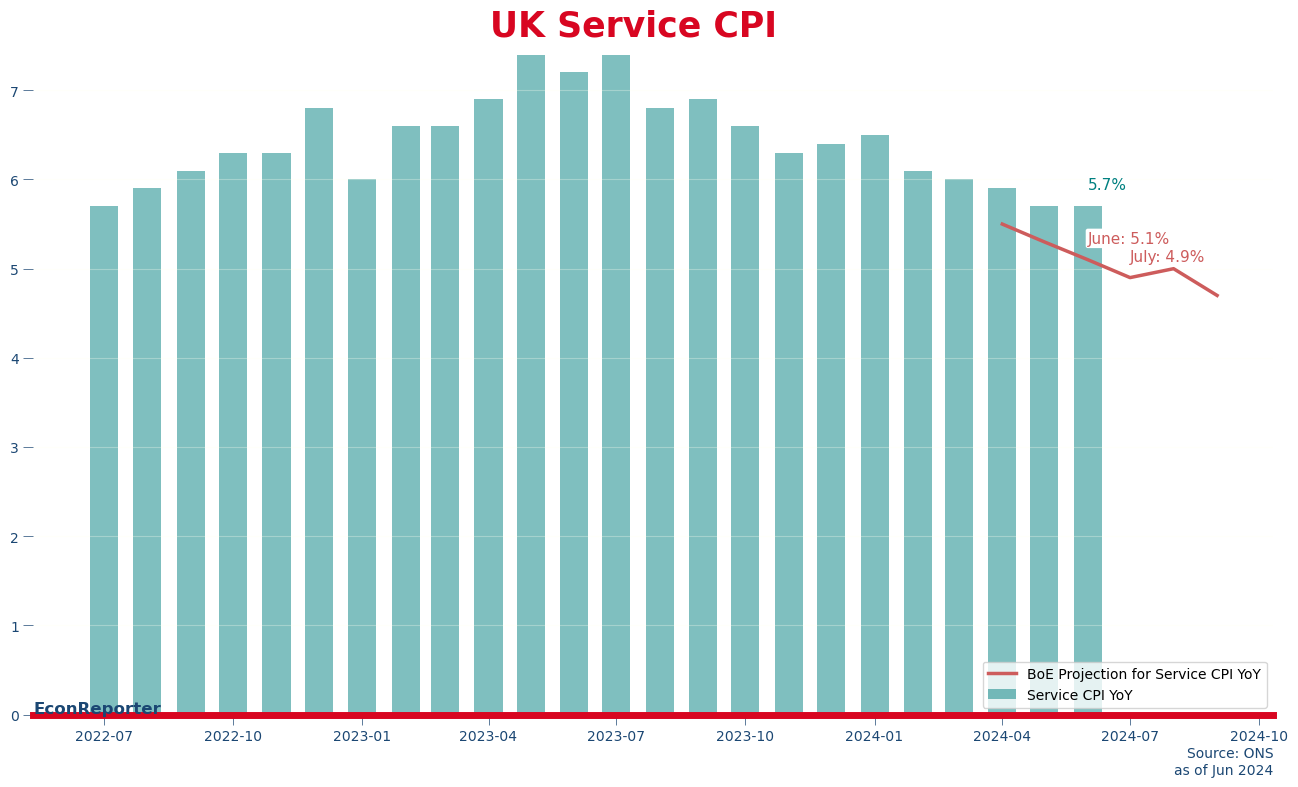

Services consumer price inflation had been 5.7% in June, unchanged from May and stronger than had been expected in the May Report, but broadly as expected since the MPC’s previous meeting and lower than earlier in the year.

簡意就係「的確高過5月貨幣政策報告嘅預測,但同之前會議時預期嘅差唔多,亦較一年前為低。」

第二個段落,就係講五位投贊成減息嘅官員睇法時:

The recent strength in services inflation had in part continued to reflect more volatile components of this series.

即係服務業通脹係被個別較波動嘅細項推高,示意唔需要特別擔心。

呢方面嘅問題,之前ING經濟師James Smith嘅分析提出過一個有趣例子:酒店價格CPI高企,但主要喺因為兩間納入左調查範圍嘅酒店喺6月將價格加左一位所帶動。

咁投反對嘅人又點睇?

The upside news to services inflation and GDP outturns relative to the May Report, along with continued elevated wage growth, suggested that second-round effects were having a greater impact on wage and price-setting behaviour in the economy beyond what was embodied in the modal forecast.

佢地認為服務業價格同GDP增長高過5月嘅預期,加埋人工增幅高企,都反映英國嘅「次輪通脹效應」對人工及物價嘅影響大過該行經濟模型嘅預期,所以應該等更多證據通脹上升壓力已經消散先好減息。

但好明顯,佢地呢個諗法輸左,服務業通脹高企暫時唔係太大問題。

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》