之前討論過不同年期孳息曲綫反轉嘅衰退預測能力,今次就引述St. Louis Fed網誌講講銀行係孳息曲綫反轉同衰退之間,一個潛在嘅角色。

Can an Inverted Yield Curve Cause a Recession? | St. Louis Fed

An inverted yield curve-or a situation in which market yields on shorter-term U.S. Treasury securities exceed those on longer-term securities-has been a remarkably consistent predictor of economic recessions. However, simply because inversions forecast recessions does not necessarily mean that inversions cause recessions. Why might a yield curve inversion cause economic activity to slow?

先問一問,孳息曲綫反轉對銀行營運有無影響呢?

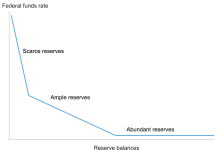

銀行最基本嘅功能係收取存款,再以之作放貸收息。一般而言存款主要以活期存款(即係存戶幾時都可以提款)為主,但放貸時通常都係有頗長嘅還款期(例如按揭,一般都十幾二十年),所以我地都會講銀行係「借短貸長」嘅生意。

同孳息曲綫有咩關係?「借短貸長」之所以有利可圖,某程度係因為孳息曲綫右向上斜,即係長息高過短息,銀行利息收入普遍係較高嘅長息,支付嘅利息開支則係較低嘅短息,一來一回就有利差收入。

孳息曲綫反轉就會令銀行嘅息差收入大減,甚至可能虧蝕。之後可能令銀行減少正常嘅商業貸款運動,令整體經濟投資受拖累,經濟增長減慢。

簡化理論如此,但實際情況係咪咁?St. Louis Fed篇網誌就利用聯儲局嘅銀行借貸要求調查數據(Senior Loan Officer Opinion Survey on Bank Lending Practices, SLOOS),黎做簡單驗證。

首先係10月份嘅SLOOS,就有直接問及孳息曲綫反轉會點影響銀行放貸行為嘅問題。銀行業嘅回應主要係孳息曲綫反轉相信會

1)預視經濟轉差

2)令銀行收入減少

3)銀行因而收緊放貸條件。

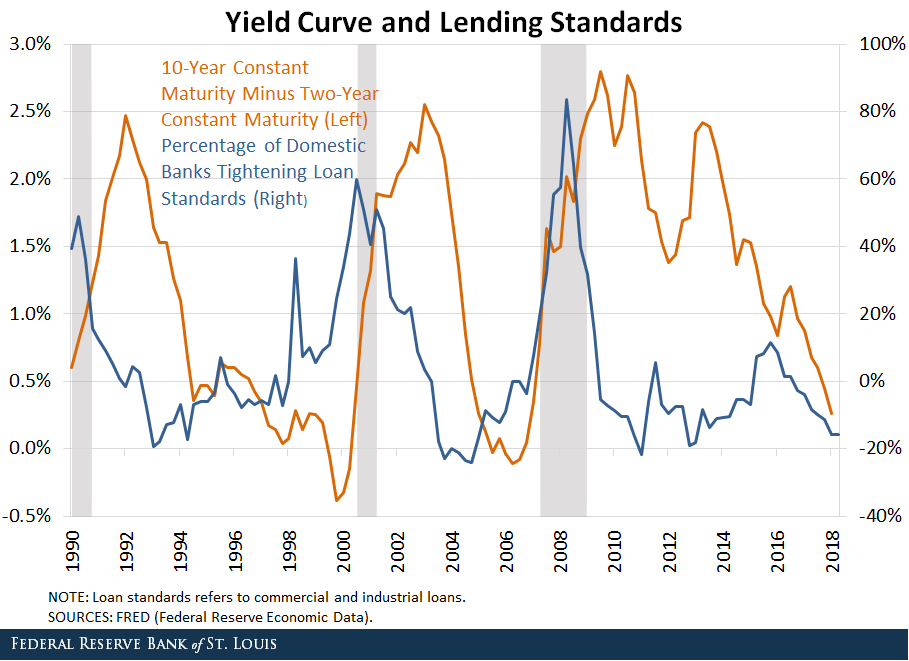

上圖就係10年期減2年期孳息曲綫,同埋SLOOS中表示會收緊信貸條件嘅銀行佔比。

可以見到嘅係,1990年以黎三次衰退(灰色區域)收緊信貸要求嘅比例都係急升嘅,而圖表明顯可見嘅係2000年及2008年衰退時,收緊要求係與孳息曲綫反轉(即橙綫見負,睇右軸)同時出現。呢個係同上述理論一致嘅情況。

但值得一提係,到2018年10月報告顯示嘅貸款要求仍然非常寬鬆,未有收緊。到底今次唔同啲?定係衰退不會來?又或者數據只係未反映,最衰時刻仍未到來?

SLOOS係一月會有新一份調查結果公佈,好值得留意。

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》