最後更新日: 2024年01月23日

今次聯儲局議息除了再一次加息值得留意,更值得留意是聯儲局就資產負債表正常化定下明確的計劃,更特別為此發出一份附錄。以上就為這份附錄的要點:

首先,聯儲局表明在縮減資產表的行動開始後,該局會每月贖回價值60億美元的美國國債本金,並會每三個月將贖回上限調升60億美元,直至計劃開始後一年,上限調升至每月300億美元。

For payments of principal that the Federal Reserve receives from maturing Treasury securities, the Committee anticipates that the cap will be $6 billion per month initially and will increase in steps of $6 billion at three-month intervals over 12 months until it reaches $30 billion per month.

按揭抵押券(MBS)方面,聯儲局則會在縮減資產表行動開始後每月贖回最多40億美元本金,然後亦會每三個月將贖回上限調升40億美元,直至計劃啟動後一年上限升至每月200億美元。

For payments of principal that the Federal Reserve receives from its holdings of agency debt and mortgage-backed securities, the Committee anticipates that the cap will be $4 billion per month initially and will increase in steps of $4 billion at three-month intervals over 12 months until it reaches $20 billion per month.

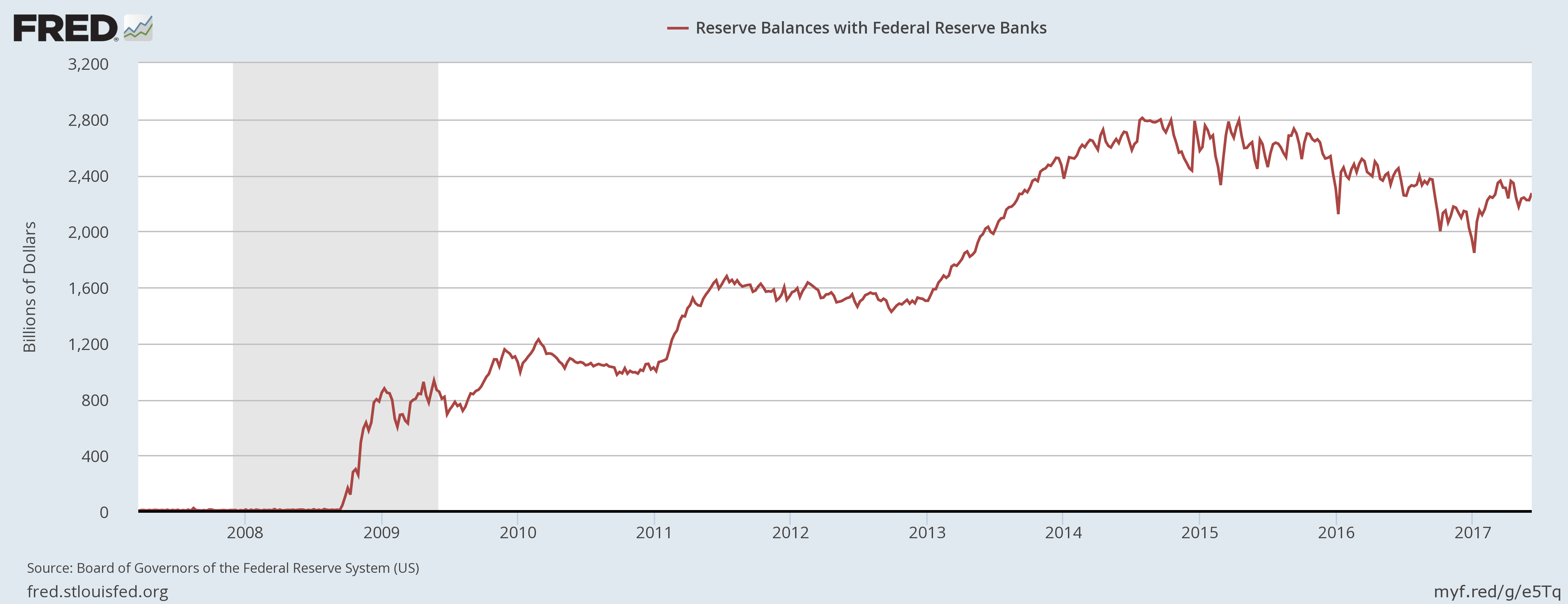

當兩者的每月贖回上限升至目標水平,聯儲局就會繼續以該每月贖回額回收投資本金。在回收投資本金的同時,聯儲局負債中的「銀行儲備」(Reserves)總額亦會相應減少,目前聯儲局未有定明儲備要減到幾少才為之「正常」,只列明大方向是「儲備水平會高於金融海嘯前,但顯著低於現水平」。

Gradually reducing the Federal Reserve’s securities holdings will result in a declining supply of reserve balances. The Committee currently anticipates reducing the quantity of reserve balances, over time, to a level appreciably below that seen in recent years but larger than before the financial crisis;

而局方亦指儲備回歸正常水平後,「將會反映銀行系統的儲備需求及FOMC認為最有效地推行貨幣政策的方法」

the level will reflect the banking system’s demand for reserve balances and the Committee’s decisions about how to implement monetary policy most efficiently and effectively in the future.

總而言之,在這份附錄未有交代的重點有:

– 計劃開始的日期

– 資產負債表會縮減至哪個水平

– 在完縮減資產負債表後,聯儲局會否仍然採用IOER及ONRRP作為利率調控工具

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》