Jackson Hole年會最為大眾注視的,當然是Yellen的演說,但其實對這年會有多個演講環節,其中最矚目的,相信是諾貝爾經濟學獎得主Chris Sims的演說,題為《Fiscal Policy, Monetary Policy and Central Bank Independence》,內容主旨是他多年來提倡的以Fiscal Theory of Price Level解釋通脹。

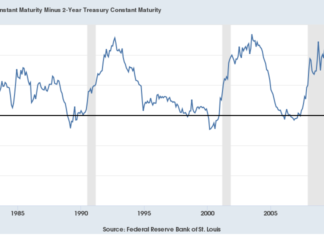

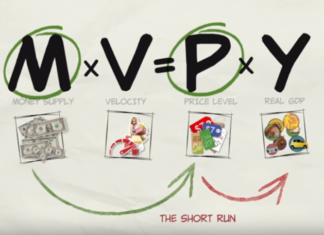

Fiscal Theory是Quantity Theory of Money以外對通脹的另一理解方法,這理論的基礎等式是政府的實質債務負擔,必然與政府未來的財政盈餘折現值相等,等式如下:

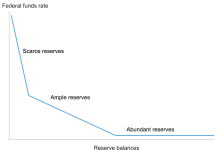

從這個理論可以見到,物價(P)上升之因,可以是政府債務上升、財政盈餘增加或折現利率上升三者。這個理論為何對經濟現況重要呢?就是因為目前的經濟困難,在於減息及增加貨幣供應都無法推高通脹,在主流經濟理論這是個難題。但若果從Fiscal Theory看來,這難題不太解,央行下調基準利率就會降低折現利率,假設一切不變,這是會令通脹下降。

更重要的是Fiscal Theory強調貨幣政策與財政政策之間的合作與協調,不再是單靠貨幣政策解決通脹問題,剛好這個時候各方都開始思考央行是否用盡彈藥,需要財政刺激政策,甚至Helicopter Money來達到通脹目標,這時Fiscal Theory 的理論推論更值得考量。

以下為Sims這篇論文的簡介:

Several recent monetary policy issues and puzzles can be understood more clearly if the traditional exclusion of the government budget constraint from macroeconomic models is relaxed. The existing literature in this area has mainly worked with multi-equation models that may seem forbidding or unrealistic. Here by discussing some specific policy issues less formally, we hope to bring the interac- tion of monetary and fiscal policy down to earth.

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》