如果說今個星期最大的新聞是大陸「暫停」「熔斷機制」,我會說第二大(但在香港較少人討論)的新聞,是沙地阿拉伯的二號王儲(兼第二副相及國防大臣)Saudi Aramco有多巨型?Mohammad bin Salman接受 The Economist訪問時提到,沙地有意讓該國最大油企Aramco招股上市,獲不少英文財金媒體爭相報道。

有關言論是來自其於 The Economist 的專訪中這一條問答:

The Economist: Can you imagine selling shares in Saudi Aramco?Miohammad bin Salman: This is something that is being reviewed, and we believe a decision will be made over the next few months. Personally I’m enthusiastic about this step. I believe it is in the interest of the Saudi market, and it is in the interest of Aramco, and it is for the interest of more transparency, and to counter corruption, if any, that may be circling around Aramco.

為何各財經媒體會覺得這消息震撼? 首先,當然是對一向在財政及國有企業管理上較封閉的沙特,近期先後推行緊縮政策、研究推沙地股票交易所上市等「前衛」的經濟政策,似乎對經濟改革頗積極;但更重要的原因,是Saudi Aramco本身是一家極巨型的油企,在油業的影響力大之餘,亦對沙地經濟有重要地位。

(要先指出,本人並非中東或石油業專家,以下的資訊為轉述幾家財經媒體的資料,但我認為各位都有需要對這新聞有基本的了解,以更好了解日後的發展。)

Saudi Aramco有多巨型?財經界的估算是Aramco的市值將可輕易大於現時全球最高市值的Apple (最高曾高至7750億美元,現約5348億美元),FT的報道甚至指,Aramco可成為史上首間一萬億市值上市公司。(Bloomberg的報道更指,就算以極保守的每桶油價值10美元計,Aramco都價值2.5萬億美元。)

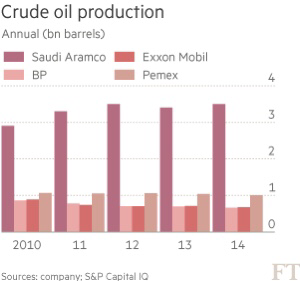

為甚麼?簡單一句就是Aramco是全球最大的油企。擁有約佔全球已知石油儲備16%(約2680億桶),這是西方石油巨企Exxon的11倍!再看一看下圖,Aramco每年油產量佔全球產量12.5%,比Exxon、BP及Pemex加起來更多!

當然,目前除了上述Mohammed bin Salman 的一句回應外,就只有Suadi Aramco在週五發佈的一份聲明,講述上市的可能:

Saudi Aramco confirms that it has been studying various options to allow broad public participation in its equity through the listing in the capital markets of an appropriate percentage of the Company’s shares and/or the listing of a bundle of its downstream subsidiaries.

Once the study of these various options is complete, the findings will be presented to the Company’s Board of Directors which will make its recommendations to the Saudi Aramco Supreme Council.

This proposal is consistent with the broad and progressive direction pursued by the Kingdom for reforms, including privatization in various sectors of the Saudi economy and deregulation of markets, which the Company strongly supports.

Saudi Aramco would like to emphasize that this process will strengthen the Company’s focus on its long term vision of becoming the world’s leading energy and chemical enterprise. This includes prudently managing the Kingdom’s hydrocarbon resources, adding value across the value chain, reliably meeting its customers’ demand, and meeting its stakeholder and environmental commitments.

可以見到,目前只是研究階階段,未知上市詳情如何。值得期待的細節包括: 到底是將主公司放上市,或是分拆部份資產上市;上市的話又會放多少股權出來?這兩大問題仍是未有答案,但分析都相信沙地政府只會放售公司極少量股權,因為上市的重點將只是為Aramco的資產定價,及向外區展示該國有意增加經濟的「透明度」。這可從二王儲的訪問中這一問答見到:

The Economist: This is a Thatcher revolution for Saudi Arabia?

Mohammad bin Salman: Most certainly. We have many great, unutilised assets. And we have also special sectors that can grow very quickly.

另一個有趣的地方,是上述的萬億市值只為簡單估算,Bloomberg這篇文章就提,到不少國家油企上市後,其市值可能反而會被市場大幅低估,例子包括露西亞油企Rosneft。前者的油產量與Chevron差不多,同為約500萬桶一日,但市值就只有350億美元,明顯低於Chevron的1600億美元。市值低估的成因簡單,因為這些國家油企有明顯的政治風險,國家利益大於股東利益。

這些都可見,Suadi Aramco上市一事,不但有能力影響全球金融市場,更可以頗有趣,值得留意。

參考資料:

Too Big to Value: Why Saudi Aramco Is in a League of Its Own

Saudi Arabia considers Aramco share sale

Saudi Aramco confirms share listing deliberations

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》