最後更新日: 2023年04月09日

聯儲局暫不加息,除了令投資市場更多不確定性,亦令到我這類經濟記者多些話題同大家分享,當中加息不加息的考量,是一個有趣的題目。

今日同大家一齊,讀一讀San Francisco聯儲銀行主席John Williams在9月28日的演講稿。講稿的主題正是加息的利弊。

不加息的原因,其實都是上次聯儲局議息會議聲明所述的一樣,全球各地都出現經濟問題,例如中國、巴西甚至歐洲,經濟情況都未如理想,Williams指出這會令美元升值,拖低美國經濟增長及通脹率:

Economic conditions and policies from China to Europe to Brazil have contributed to a substantial increase in the dollar’s value. This has held back U.S. growth and inflation over the past year.4 Further bad news from abroad could add to these effects.

👀Advertisement👀

另一方面,由於貨幣政策有所謂的Zero lower bound (零息下限), Williams 認為這令貨幣政策在加與不加的選擇上,兩個選項並不對等。即是如果經濟轉差,聯儲局減息刺激經濟的能力有限。但如果是高通脹,聯儲局可以簡單利用加息壓抑。

For one, we are constrained by the zero lower bound in monetary policy and this creates an asymmetry in our ability to respond to changing circumstances. That is, we can’t move rates much below zero if the economy slows or inflation declines even further. By contrast, if we delay, and growth or inflation pick up quickly, we can easily raise rates in response

但支持加息又有甚麼理由? Williams提出的第一大理由,正是Milton Friedman指出貨幣政策有Long and Variable Lag的問題,即是有如在紅燈前要停車,總不能在到達紅燈的一刻才踏下腳制,因為車要停下來亦需時,以這個角度看,加息就應該要在通脹走勢剛開始就執行。Williams亦指,早些加息可以令整個利率正常化過程更緩慢,更有序,不用在通脹急升時才急急大幅加息。

In addition, an earlier start to raising rates would allow us to engineer a smoother, more gradual process of policy normalization. That would give us space to fine-tune our responses to react to economic conditions. In contrast, raising rates too late would force us into the position of a steeper and more abrupt path of rate hikes, which doesn’t leave much room for maneuver. Not to mention, it could roil financial markets and slow the economy in unintended ways.

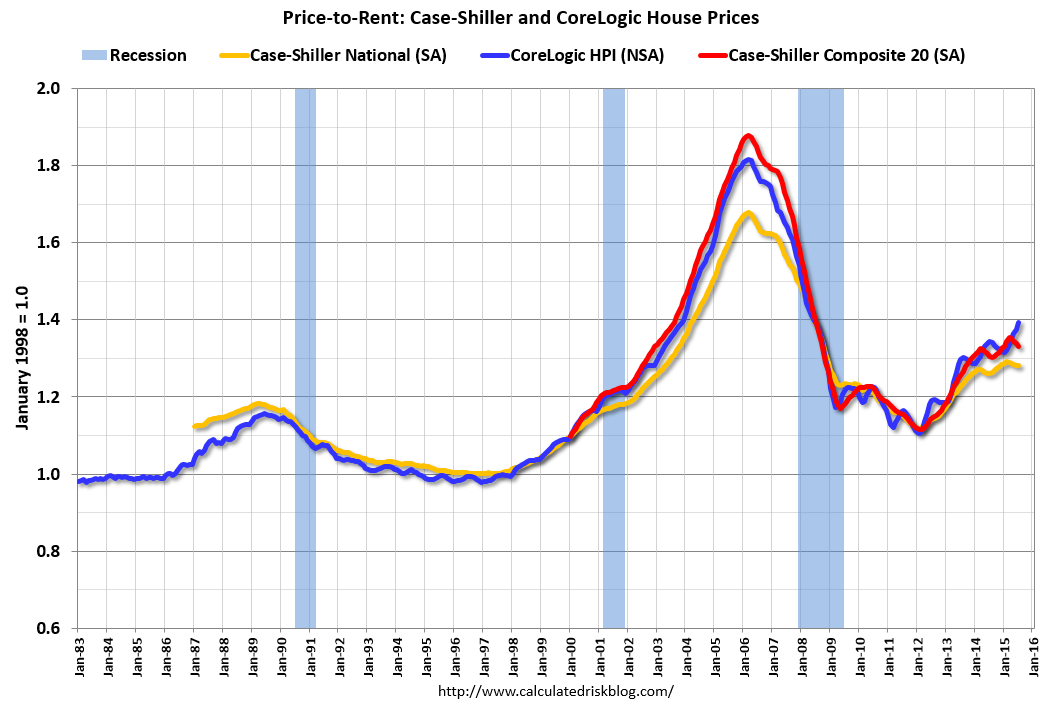

好啦,我認為講稿的重中之重來啦! Williams 認為長期低息的一大問題,就是推高資產價格,他特別提及現時的樓價對租金比例已經上升到2003年的水平:

I am starting to see signs of imbalances emerge in the form of high asset prices, especially in real estate, and that trips the alert system. One lesson I have taken from past episodes is that, once the imbalances have grown large, the options to deal with them are limited. I think back to the mid-2000s, when we faced the question of whether the Fed should raise rates and risk pricking the bubble or let things run full steam ahead and deal with the consequences later. What stayed with me were not the relative merits of either case, but the fact that by then, with the housing boom in full swing, it was already too late to avoid bad outcomes. Stopping the fallout would’ve required acting much earlier, when the problems were still manageable.

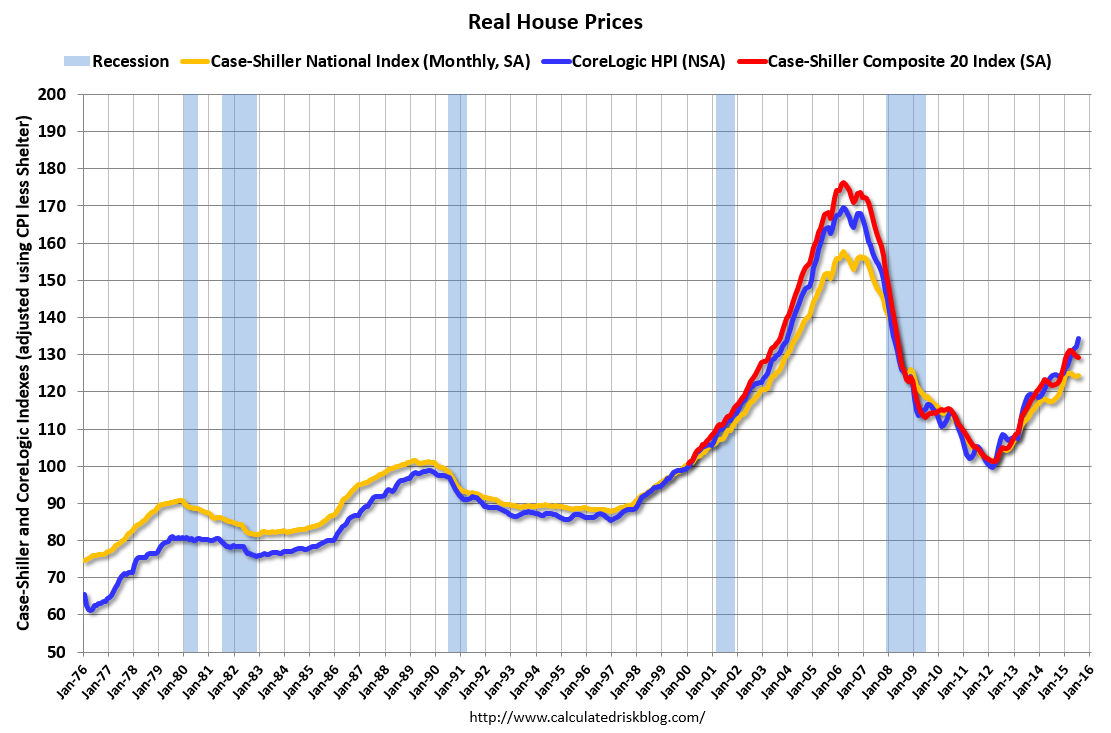

這個問題上,我就要借用Calculated Risk的樓價圖給大家看看,先是實質樓價指數(即除去通脹)

確實回到2003年的水平,但可以見到走勢較平,即是升幅不如之前的急。

到底美國樓價問題值不值得擔心?我不清楚,但值得留意。

資料來源:Real Prices and Price-to-Rent Ratio in July

Cover Photo: Stefani A.

本網內容全數由Patreon嘅讀者贊助

如果你都鐘意我地嘅文章,可以考慮成為我地最新嘅Sponsor !

想睇到我地最新嘅文章,可以去Telegram follow 我地 詳見《Econ記者使用說明》